what is fsa health care 2022

But the late announcement left. Flexible Spending Accounts program - new 2022 limits for the HCFSA and LEX HCFSA.

The 2022 Fsa Contribution Limits Are Here

Free Torn Lens Replacement.

. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. So if you had 1000 in your account at the end of this year you could carry it all over into 2022. The IRS announced that for plan year January 1 through December 31 2022 federal employees can contribute 100 more into their health care flexible spending account HCFSA or limited expenses health care flexible spending account LEXHCFSA during 2022 compared to what they could contribute during plan year 2021.

As a result the IRS has revised contribution limits for 2022. For 2022 participants may contribute up to an annual. Flexible Spending Account FSA An FSA is similar to an HSA but there are a few key differences.

An FSA is a tax-advantaged way for you to pay for certain medical expenses. The Navia Benefits Debit MasterCard. Employees can contribute up to 2850 to their LPFSAs in 2022 up 100 from 2021The HSA contribution limit for an individual is 3650 in 2022.

Contact Us at 1-888-372-1450FAQ Chat in real time. This means youll save an amount equal to the taxes you would have paid on the money you set aside. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year.

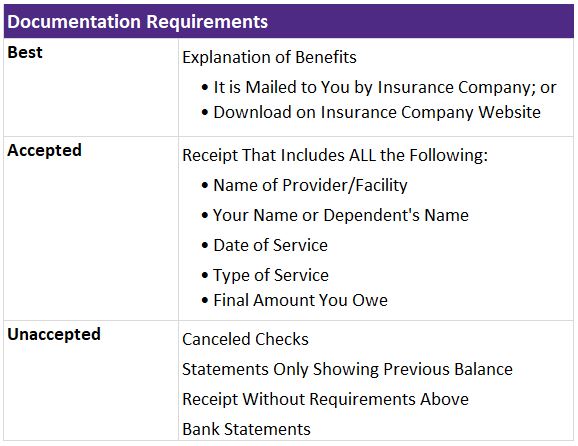

A flexible spending account FSA a health savings account HSA a health reimbursement arrangement HRA a limited-purpose flexible spending account LPFSA or a dependent care flexible spending account cannot be used to pay shaving cream or lotion DCFSA Do you need assistance. Dependent Care Flexible Spending Account FSA. FSAs only have one limit for individual and family health plan participation but.

Get a free demo. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. If you have a dependent care FSA pay special attention to the limit change.

2 days agoAn EPO plan is a type of health insurance that helps pay for medical care but only if its from doctors and hospitals within the plans network. For one self-employed individuals. The usual carry-over limit is 550.

When you get medical treatment in. Elevate your health benefits. However if you contribute too much to these accounts you could lose all your funds at the end of the year.

You can contribute pretax dollars to fund the account. There are some qualifications to be eligible to take advantage of the full amount. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. Mabis Healthcare Cane Ice Grip Tip For Cane Crutch In 2022 Cane Tips Crutches Health Care. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

Some premiums as low as 0month. You dont pay taxes on this money. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses they incur while at work.

The health FSA contribution limit is 2850 for 2022 up from 2750 in the prior year. The IRS sets dependent care FSA contribution limits for each year. A flexible spending account FSA is an employer-sponsored benefit that helps you save money on many qualified healthcare expenses.

You can use this account for these types of expenses and you can use it to pay for everything from prescriptions to dental treatments. Some plans may offer additional coverage for prescription drugs dental and vision. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the Limited Expense Health Care FSA LEX HCFSA.

Glucosamine Chondroitin Msm Vitamin D3 Joint Health Supplement Advanced Joint Support Tablets For Men Women With Vitamin D3 To Support Bone Immune Health Fa In 2022 Glucosamine Chondroitin Msm Chondroitin. Ad Compare plans prices and star ratings online. The IRS hasnt yet announced 2022 limits but your employer can tell you during open enrollment what limits they will be allowing.

Arpa increased the dependent care fsa limit to 10500 for calendar year 2021. The IRS has announced the new health savings account limits for. Dependent Care FSA Contribution Limits for 2022.

Easy implementation and comprehensive employee education available 247. The Navia Benefits Card will only load the amount contributed so far to your Day Care FSA. The annual contribution limit for your health care flexible spending accounts health FSAs is on the rise for 2022 according to the Society for Human Resource Management.

Dependent Care Fsa Limit 2022. For 2022 the IRS caps employee contributions to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately. Ad Custom benefits solutions for your business needs.

Ad Free Shipping No Hidden Fees. The employee incurs 7000 in dependent care expenses during the period from january 1 2022 through june 30 2022 and is reimbursed 7000 by the dc fsa. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

This would result in a 6500 tax deduction if both accounts are fully funded in 2022. These expenses arent covered by your employers health insurance plan but they are eligible.

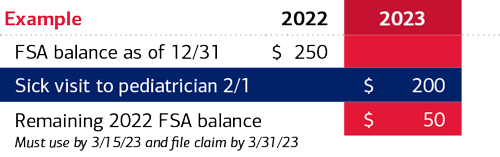

Understanding The Year End Spending Rules For Your Health Account

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

The 2022 Fsa Contribution Limits Are Here

Understanding The Year End Spending Rules For Your Health Account

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

What Is A Dependent Care Fsa Wex Inc

What S The Difference Between An Fsa And Hsa Forbes Advisor

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Health Care Flexible Spending Accounts Human Resources University Of Michigan

Hra Vs Fsa See The Benefits Of Each Wex Inc

What Is An Fsa Definition Eligible Expenses More

Flexible Spending Account Contribution Limits For 2022 Goodrx

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Fsa Carryover What It Is And What It Means For You Wex Inc

The Difference Between Hsas And Fsas Employee Benefits Ves

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Health Care And Limited Use Fsa Human Resources Northwestern University